Over the past few years, affordability has been one of the biggest hurdles for homebuyers. With home prices climbing and mortgage rates increasing, it’s no surprise that many have felt stuck—unsure of when or how to make their move.

But here's the good news: the tide may be turning. Although affordability is still a key concern, recent trends show that mortgage rates have started to stabilize. This welcome change could make your homebuying journey more manageable and less daunting.

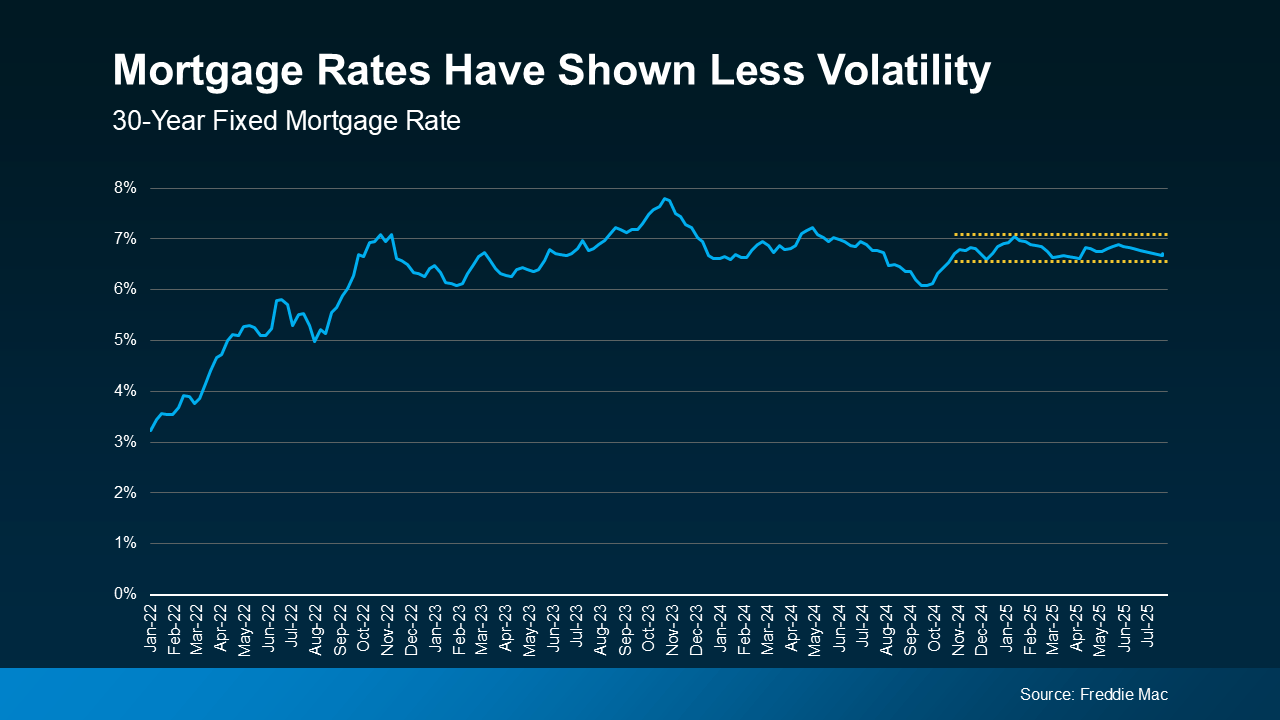

Mortgage Rates Have Settled into a Steady Range

In the last year, mortgage rates have experienced their fair share of ups and downs, making it difficult for many buyers to plan with confidence. Recently, however, things have shifted in a more favorable direction. Rates have now settled into a narrower range, reducing the volatility that once made the market feel unpredictable (see graph below):

As the graph illustrates, mortgage rates have been moving within a half-percentage-point band since late last year. Although there’s still some fluctuation, we’re no longer seeing the dramatic spikes and dips that characterized previous months. This newfound steadiness is more significant than it may appear. As noted by HousingWire:

“Analysts, economists and mortgage professionals are coining this quarter’s activity as one of the most ‘calm’ periods for mortgage rates in recent memory.”

Why This Is Great News for Buyers

Let’s face it—uncertainty can be a major barrier when planning a big financial decision like buying a home. When mortgage rates are unpredictable, it’s difficult to estimate your monthly payment or feel secure in your budget. But with rates holding steady over the past few months, you now have a clearer picture of what to expect. This opens the door to more informed decisions and less stress as you plan your next steps.

So if you’ve been waiting for the right moment, this could be it. Even though rates may not be at historic lows, their current stability offers a valuable opportunity to move forward with more confidence.

Will This Trend Continue?

Experts believe this period of steadiness might stick around for a bit longer. While we may see a gradual decline in rates, it’s likely to be slow and steady rather than dramatic. Danielle Hale, Chief Economist at Realtor.com, shares this perspective:

“I expect a generally downward trend for rates this year, but at a slow enough pace that it might not be noticeable in any given month.”

This makes it clear: trying to time the market perfectly is both difficult and potentially counterproductive. Jeff Ostrowski, Housing Market Analyst at Bankrate, echoes this sentiment:

“Trying to time mortgage rates is really difficult. There’s no guarantee that rates are going to be any more favorable in three months or six months.”

Looking at long-term forecasts, many experts agree. Two out of three major projections suggest that mortgage rates will remain in the mid-6% range well into 2026 (see graph below):

This outlook reinforces the idea that today’s market may offer a window of opportunity. As Sam Khater, Chief Economist at Freddie Mac, puts it:

“Mortgage rates have moved within a narrow range for the past few months . . . Rate stability, improving inventory and slower house price growth are an encouraging combination . . .”

Of course, mortgage rates are still subject to change due to various economic factors, including inflation and shifts in the broader economy. But for now, the market is offering a more predictable environment—something that can be a game-changer for buyers.

Bottom Line

While affordability challenges remain, the recent stability in mortgage rates is a welcome development for homebuyers. With less volatility, planning your next move has become more practical and less stressful.

If you’re curious about what your monthly payment might look like or want to explore your options, now is a smart time to act. Reach out to an agent or lender to start the conversation and take the first step toward making your homeownership dreams a reality.

For more information, or to speak with an expert, contact Mike Panza and the team at Panza Home Group. They’re here to help guide you through every step of the process. Visit https://panzarealestate.com/team/mike-panza to get started.