There’s no shortage of headlines today warning about a looming housing market crash. But those stories often miss the bigger picture. In reality, the housing market is showing signs of long-term stability, not collapse. Here’s what’s truly unfolding—and what top industry experts predict for home prices in the coming years. Spoiler: it’s not a crash.

While some local markets are experiencing slight price dips or leveling off due to increased inventory, this is a typical response in a growing market. It’s important to zoom out and focus on the national trends, which paint a far more reassuring picture than the fear-driven headlines suggest.

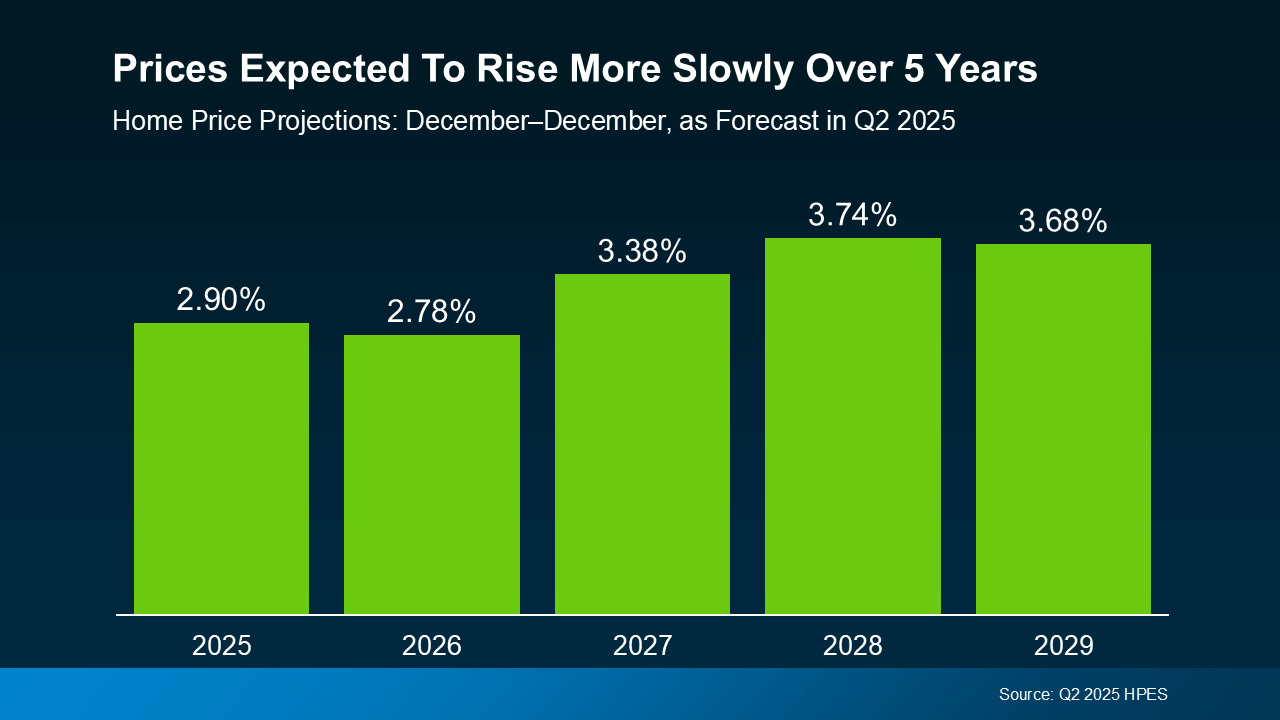

According to the latest Home Price Expectations Survey (HPES) from Fannie Mae, over 100 respected housing market experts were asked to weigh in on what’s ahead. The consensus? Home prices are expected to keep climbing over the next five years—just at a more moderate, sustainable pace compared to the rapid increases of recent years. That kind of growth is a positive sign for both buyers and sellers, indicating a more balanced and healthier market overall (see graph below):

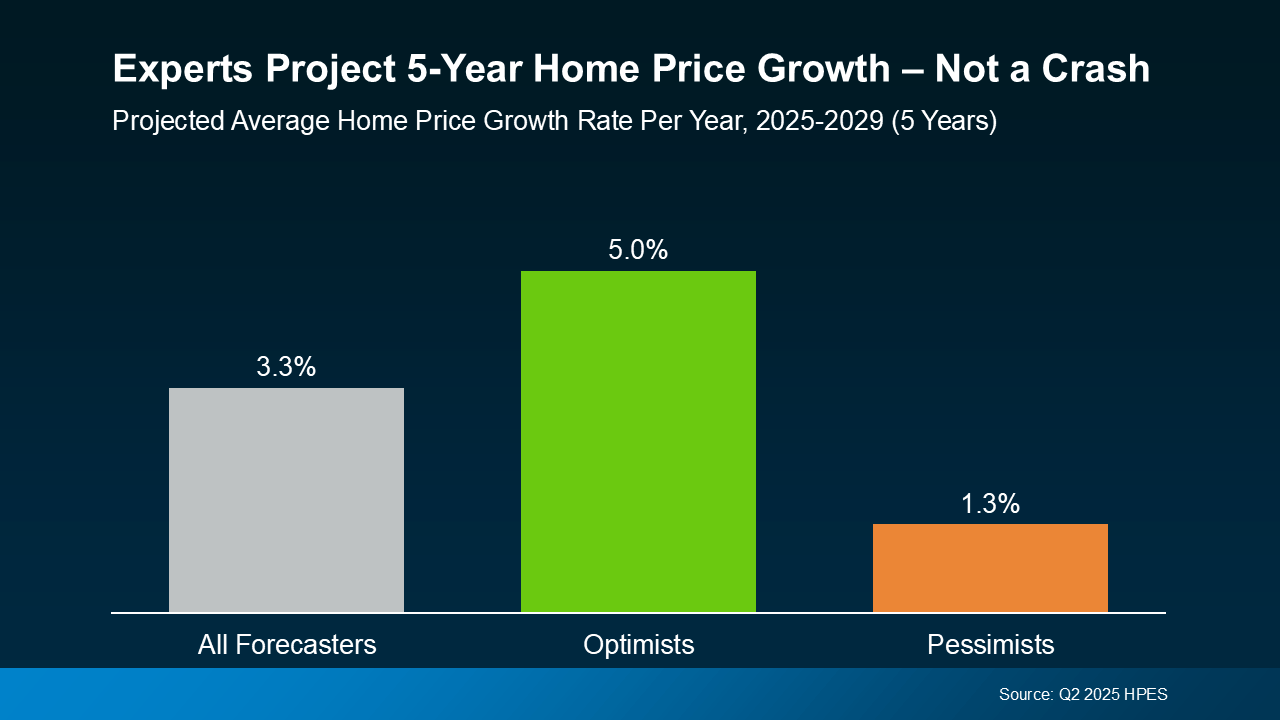

The survey responses fall into three categories: the most optimistic experts, the most cautious, and the overall average. Here’s what they project:

- The average forecast anticipates about 3.3% annual home price growth through 2029.

- The optimistic group sees closer to 5.0% per year.

- Even the more conservative experts still predict 1.3% yearly growth.

While the exact percentages vary, the key takeaway is clear: not a single group foresees a major national price drop or crash. Instead, they all expect continued appreciation—just at a steadier, more manageable rate.

This is great news for the housing market and for those considering buying or selling. While some regions might see prices plateau or dip slightly in the short run—especially in areas where inventory is rising—others may experience faster-than-average growth due to limited supply and strong demand. Overall, this more moderate pace helps prevent the kind of unsustainable spikes we saw during the pandemic-driven frenzy.

Even more encouraging is that the fundamentals supporting the housing market remain strong. Foreclosures are low, lending standards are responsible, and homeowners continue to hold near-record levels of equity. These conditions create a stable foundation that helps prevent the kind of forced selling that could drive prices downward.

So, if you’re holding out for a dramatic market crash before making a move, you may be waiting longer than expected. The data shows a positive trajectory, with steady growth likely to continue for years to come.

Bottom Line

If you’re uncertain about your real estate plans, now is a great time to get the clarity you need. The market isn’t crashing—it’s evolving into a more stable and sustainable environment. Want to understand what this means for your specific area? National trends are important, but your local market matters most. Reach out to a trusted real estate expert to get tailored insights based on your zip code.

For personalized guidance and to learn more about what’s happening in your neighborhood, don’t hesitate to contact Mike Panza and the team at Panza Home Group. They’re here to help you make confident, informed decisions in today’s housing market. Learn more about connecting with them here: https://panzarealestate.com/team/mike-panza