You may have come across headlines or social media posts claiming that new home inventory is at its highest level since the 2008 housing crash. Understandably, that might raise red flags—especially if you lived through that period. But before jumping to conclusions, it's important to take a deeper look at what’s really happening in today’s market.

Much of what circulates online is crafted to grab attention and drive clicks. So while it’s true that new construction numbers are up, that’s only one part of a much bigger picture. Once you examine the full scope of housing inventory and market trends, it becomes clear that today’s situation is significantly more stable than the conditions leading up to the crash.

Why Today’s Market Isn’t Like 2008

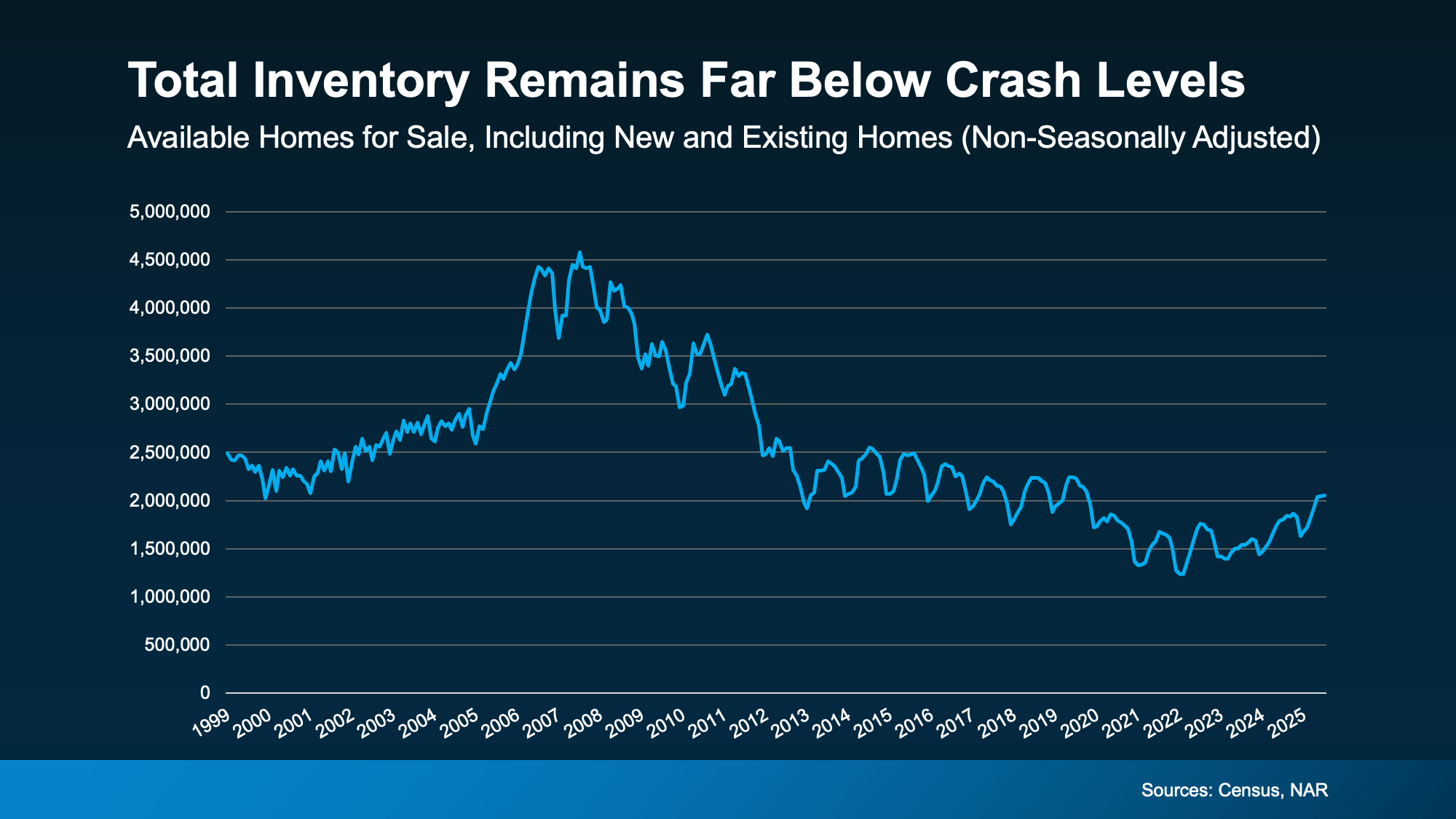

While the volume of newly built homes on the market has indeed reached its highest point since the crash, this isn’t cause for concern. That’s because today’s housing inventory is made up of both new builds and existing homes—properties that have had previous owners. When you consider both categories together, the overall supply still looks vastly different from the surplus we saw back in 2008.

Take a look at the data, and you’ll see that total housing inventory is nowhere near the levels that led to the last downturn. So while it’s technically accurate to say that new construction is high, it’s misleading to suggest we’re reliving the same conditions that caused the last crash.

Builders Are Catching Up After Years of Underbuilding

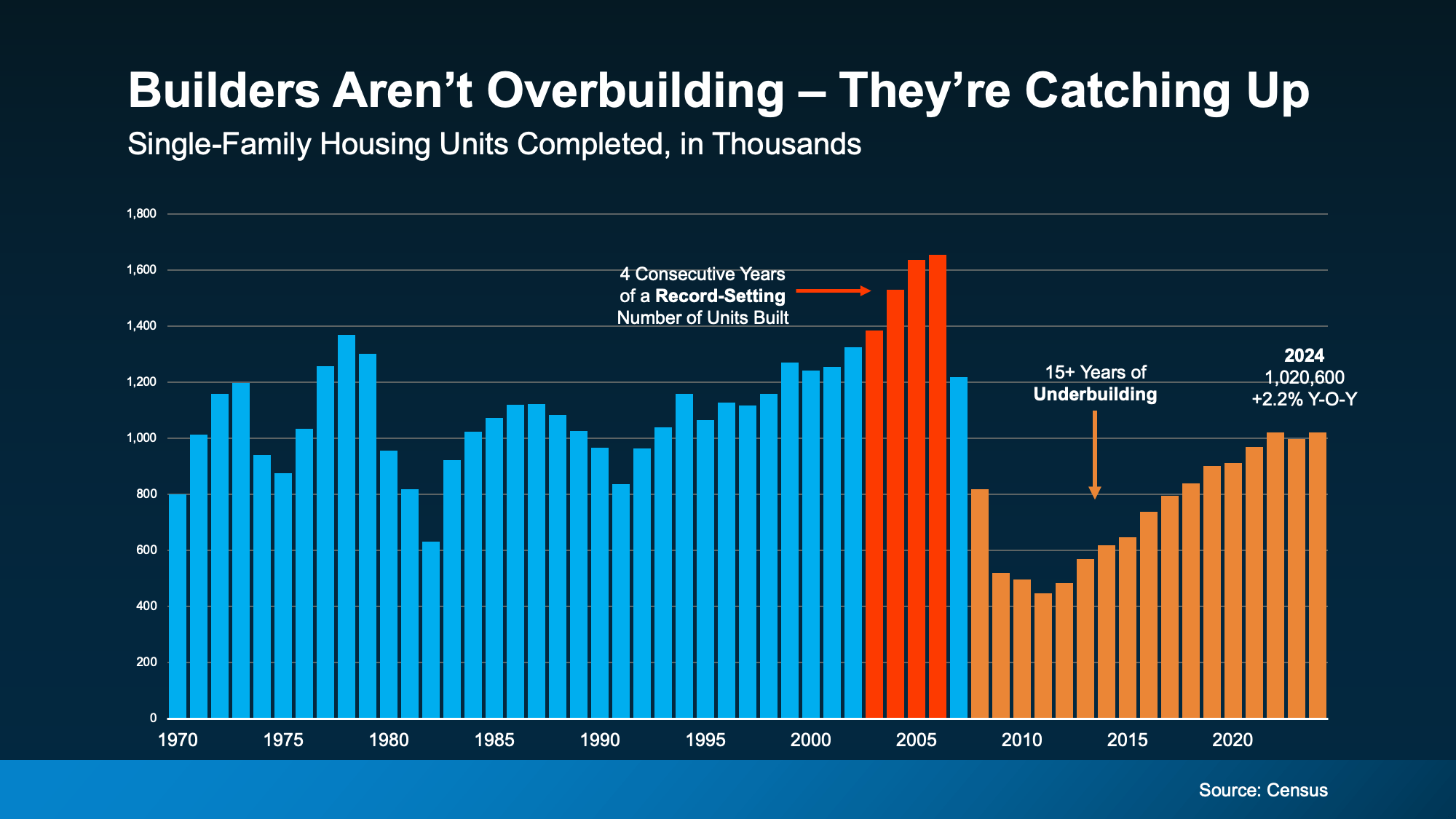

Here’s another crucial point that often gets left out of the conversation: for more than a decade after the 2008 crash, homebuilders significantly pulled back on new development. For over 15 years, construction lagged far behind demand, leading to a substantial shortage of homes across the country.

Using U.S. Census data, you can clearly see the contrast between the overbuilding that occurred before the crash (highlighted in red) and the extended period of underbuilding that followed (in orange). This long-term gap in construction created a housing shortfall we’re still working to resolve.

In fact, even with the recent uptick in new builds, we’re still playing catch-up. Experts at Realtor.com estimate it would take approximately 7.5 years of building at current rates just to bridge the existing gap in housing supply. That means the current rise in new inventory isn’t a warning sign—it’s a step toward meeting the ongoing demand.

Local Variations Still Matter

Of course, every housing market is different. Some areas may see more available homes, while others remain tight on inventory. That’s why it’s important to evaluate your local market conditions and work with a knowledgeable real estate professional who can provide insights specific to your area.

Nationally, though, the data paints an encouraging picture. We aren’t facing an oversupply like we did in 2008. Instead, we’re finally seeing builders respond to years of pent-up demand—a positive sign for the long-term health of the housing market.

Bottom Line

The rise in new home inventory doesn’t mean we’re heading for another housing crash. In fact, it signals progress in addressing a long-standing supply shortage. Today’s real estate landscape is rooted in different fundamentals, with builders working hard to meet growing demand.

If you have questions about how this trend could impact your buying or selling plans—or want to understand what’s happening with new construction in your area—reach out to Mike Panza and the team at Panza Home Group. They’re here to help you navigate the current market with confidence. For more information or to get in touch, visit: https://panzarealestate.com/team/mike-panza