For over 80 years, the Veterans Affairs (VA) home loan program has supported countless Veterans in achieving the dream of homeownership. This longstanding benefit is one of the most impactful tools available to those who’ve served. While many Veterans have access to this powerful opportunity, a surprising number are unaware of one of its biggest advantages.

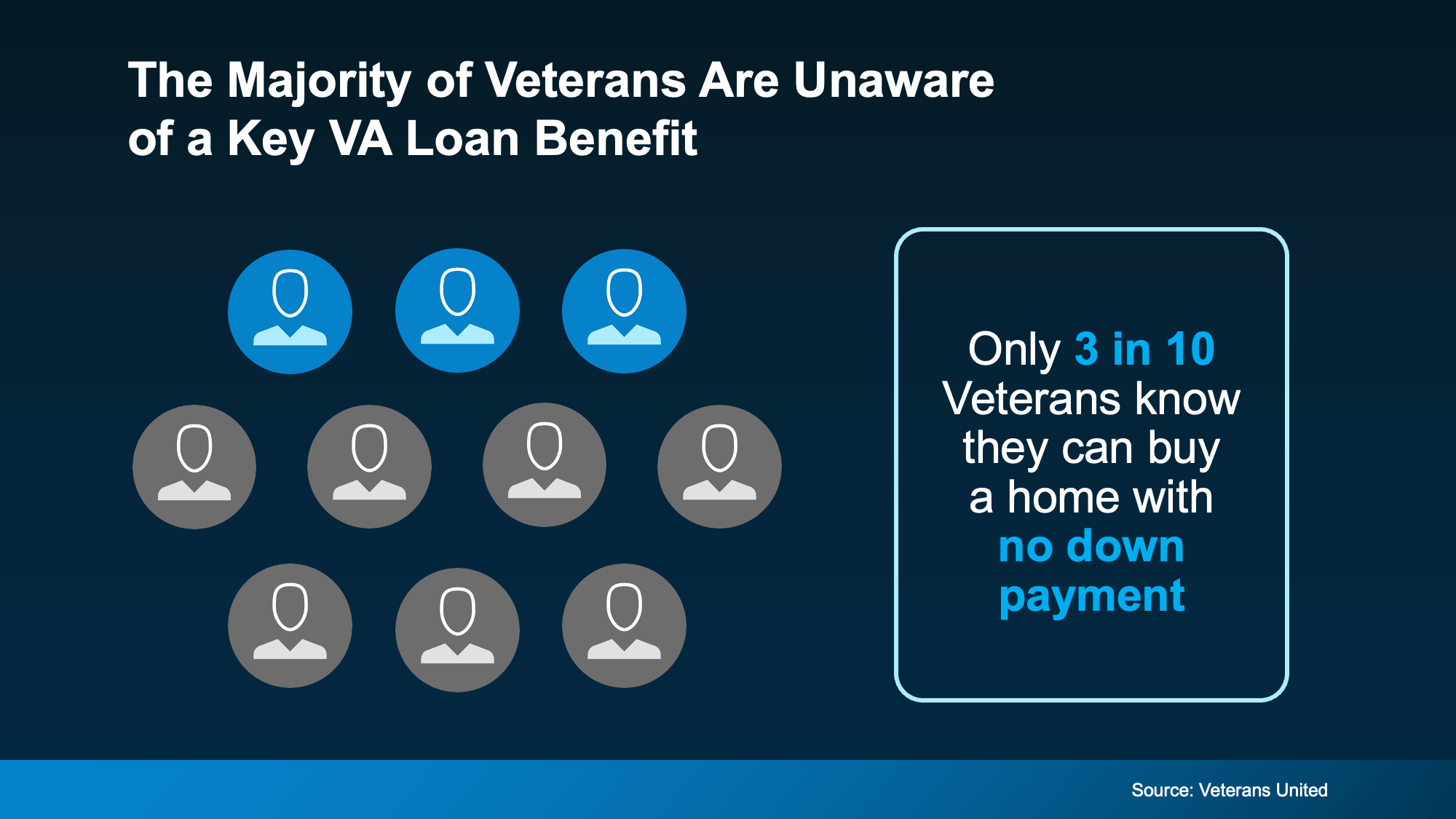

According to a report from Veterans United, only 3 in 10 Veterans know they may qualify to buy a home with no down payment through a VA loan (see visual):

That means 7 out of every 10 Veterans could be missing out on a vital homebuying advantage—one that could dramatically improve their path to homeownership.

That’s why it’s essential for Veterans and those close to them to be informed about the full range of benefits a VA home loan provides. As Veterans United highlights, VA loans:

“. . . come with a list of big-time benefits, including $0 down payment, no mortgage insurance, flexible and forgiving credit guidelines and the industry's lowest average fixed interest rates.”

The Advantages of VA Home Loans

VA loans are specifically designed to make it easier for Veterans to buy a home and start building equity—and a brighter future—for themselves and their families. These benefits not only support those who’ve served, but also help them lay down roots and find long-term stability. Here are some of the top advantages of a VA loan, according to the Department of Veterans Affairs:

Options for No Down Payment: One of the most significant advantages of a VA loan is the potential to purchase a home with no down payment. This can make homeownership more accessible and allow Veterans to move into a home faster.

Limited Closing Costs: VA loans limit the types of closing costs Veterans are required to pay, reducing the financial burden at the time of purchase and leaving more money in your pocket.

No Private Mortgage Insurance (PMI): Unlike many other loan types, VA loans do not require PMI, even with no or low down payments. This can lead to lower monthly payments and considerable long-term savings.

These features make VA loans one of the most powerful financing tools available to Veterans, especially in today’s competitive housing market. Whether you're buying your first home or relocating after service, the VA loan program offers unmatched support.

If you want to explore your options and see how a VA loan can work for you, it’s essential to connect with a team of knowledgeable professionals—a trusted lender and a local real estate agent who understand the ins and outs of the program.

Bottom Line

VA home loans provide life-changing opportunities for those who have served, offering financial advantages that can make the path to homeownership easier and more affordable. A trusted team can help ensure you take full advantage of these benefits and move forward with confidence.

Wondering if you qualify for a VA home loan? Reach out to the Mike Panza and the team at Panza Home Group for expert guidance and answers to all your questions. You can learn more and get in touch at the following link: https://panzarealestate.com/team/mike-panza